AmBetter Indiana

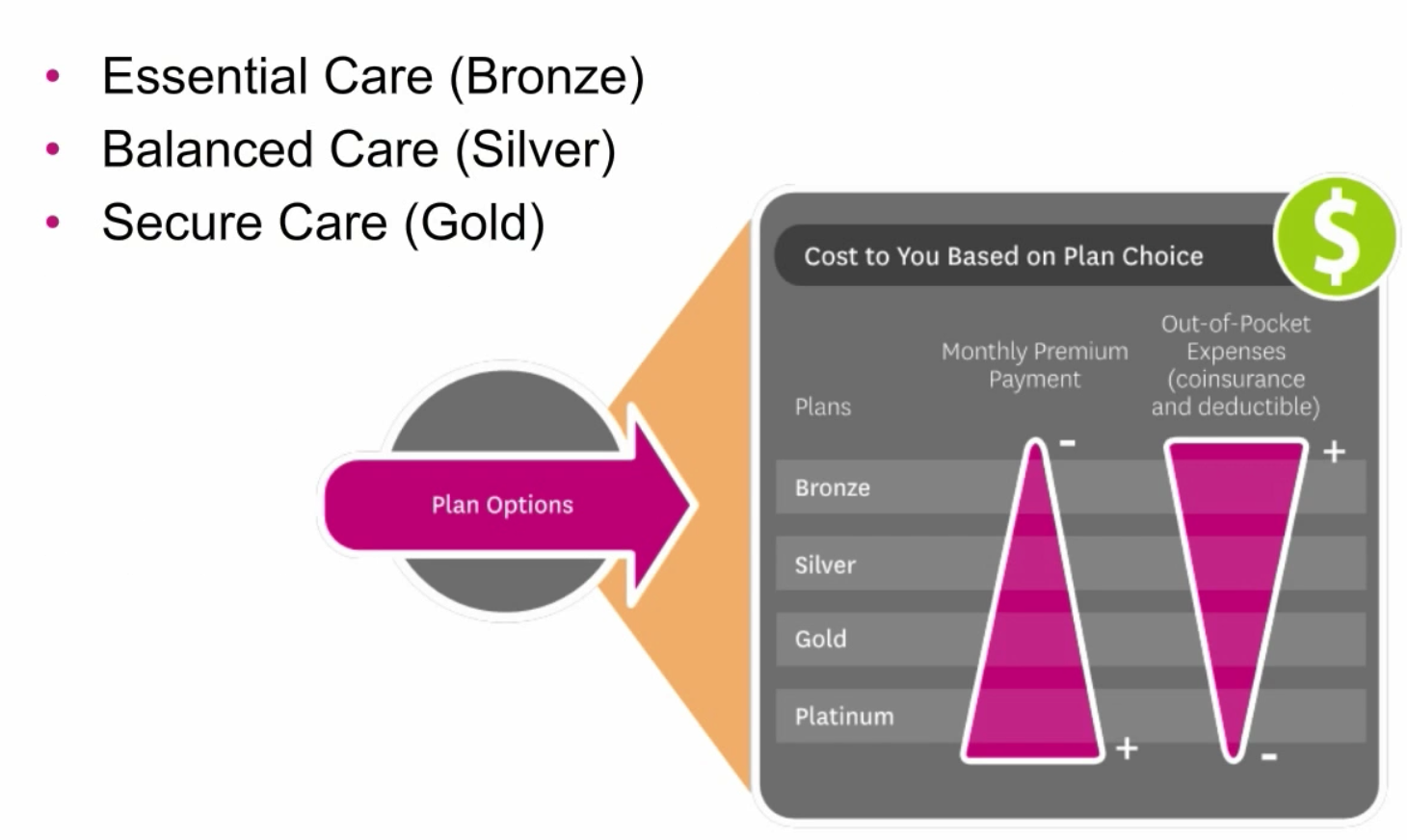

Plan Overviews

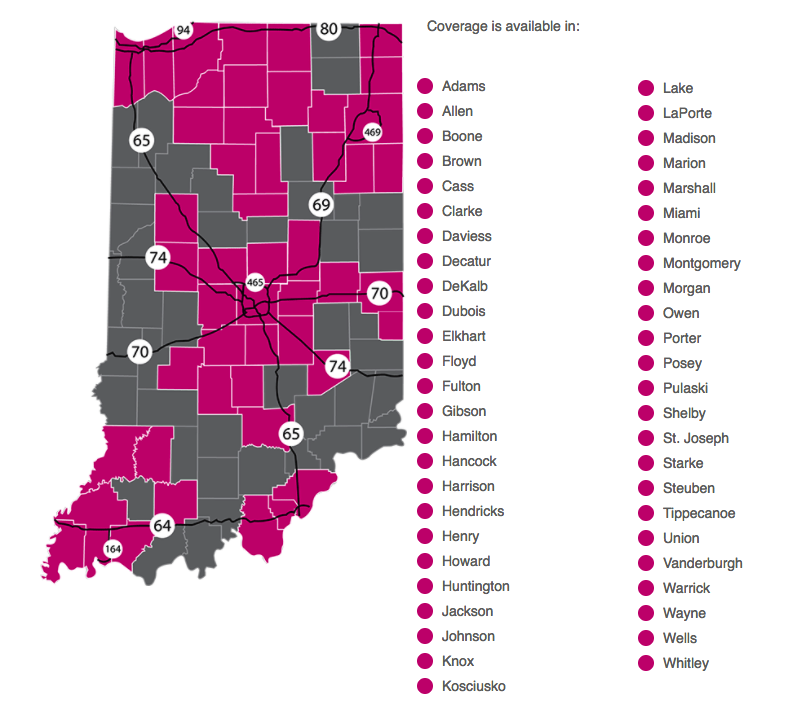

Ambetter individual and family healthcare coverage in Indiana provides affordable options in 28 counties. The parent company, Managed Health Services (MHS) has been providing quality medical coverage to Hoosier residents for 21 years. Marketplace policies can easily be purchased, and rates are often lower than other major carriers, such as UnitedHealthcare and Anthem Blue Cross and Blue Shield.

About The Parent Company MHS

MHS is a managed care provider that helps operate the Children’s Health Insurance Program (CHIP), Hoosier Healthwise, and Healthy Indiana. In addition to enrollment duties, they coordinate community events and provide public information about existing and future programs. The National Committee For Quality Assurance (NCQA) has awarded its “commendable” designation to MHS for outstanding services. MHS is actually a wholly-owned subsidiary of Centene Corporation, which is a Fortune 500 company specializing in providing services to government-funded programs for consumers that are without medical coverage. Some of these programs include Medicaid, Aged, Blind, or Disabled (ABD), and CHIP.

Gym Membership Benefits:

Ambetter’s gym membership benefits program makes it easier to stay in shape and stay healthy. With Ambetter, you can:

- Earn $20 on your My Health Pays card every month you visit the gym of your choice at least eight times.

- Get discounts on gym membership fees at approved locations. They’ve partnered with gyms and health clubs across the country. Just visit Ambetter.mhsindiana.com to find an eligible gym in your area.

| Plan Name | Secure Care 1 with 3 Free PCP Visits – Standard | Balanced Care 1 | Balanced Care 2 | Balanced Care 4 | Balanced Care 10 | Balanced Care 12 | Essential Care 1 |

|---|---|---|---|---|---|---|---|

|

Medical (Ind/Fam) |

$1,000/$2,000 | $5,500/$11,000 | $6,500/$13,000 | $7,050/$14,100 | $4,500/$9,000 | $3,500/$7,000 | $6,800/$13,600 |

|

Prescription Drug (Ind/Fam) |

$500/$1,000 | Integrated with medical ded. | Integrated with medical ded. | Integrated with medical ded. | Integrated with medical ded. | Integrated with medical ded. | Integrated with medical ded. |

| Metal Level | Gold | Silver | Silver | Silver | Silver | Silver | Bronze |

|

(Ind/Fam) |

$6,350/$12,700 | $6,500/$13,000 | $6,500/$13,000 | $7,050/$14,100 | $6,500/$13,000 | $7,150/$14,300 | $6,800/$13,600 |

| Annual Well Visit/ Preventive Care | No charge | No charge | No charge | No charge | No charge | No charge | No charge |

| PCP Office Visit | 20% after ded. | $30 | $30 | $30 | $20 | $30 | No charge after ded. |

| Specialist Office Visit | 20% after ded. | $60 | $60 | $60 | $40 | $65 | No charge after ded. |

| Imaging(CT/PET Scans, MRIs) | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| X-rays & Diagnostic Imaging | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Urgent Care | 20% after ded. | $100 | $100 | $100 | $100 | $75 | No charge after ded. |

| Emergency Room* | $250 after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | $400 after ded. | No charge after ded. |

| Emergency Transportation* | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Inpatient Facility Fee | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Inpatient Hospital Physician & Surgical Services | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Outpatient Facility Fee | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Outpatient Surgery Physician/Surgical Services | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Labs & Diagnostics | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Mental/Behavioral Health & Substance Use Disorder Outpatient Services | 20% after ded. | $30 | $30 | $30 | $20 | $30 | No charge after ded. |

| Rehabilitation Outpatient Services(Includes Speech, Occupational, Physical Therapy) | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Skilled Nursing Facility | 20% after ded. | 20% after ded. | No charge after ded. | No charge after ded. | 20% after ded. | 20% after ded. | No charge after ded. |

| Pediatric Vision- Routine Eye Exam(1 visit per year) | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered |

| Pediatric Vision- Eyeglasses(frames, 1 per year) | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered |

| Pediatric Vision- Lenses(per pair) | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered | 100% Covered |

| Pharmacy* (Generic / Preferred / Non-preferred / Specialty) | $10 / $25 after Rx ded. / $75 after Rx ded. / 30% after Rx ded. | $10 / $50 / 20% after Rx ded. / 20% after Rx ded. | $15 / $50 / No charge after ded. / No charge after ded. | $15 / $50 / No charge after ded. / No charge after ded. | $10 / $50 / 20% after ded. / 20% after ded. | $15 / $50 / $100 / 40% | $20 / No charge after ded. / No charge after ded. / No charge after ded |

| Adult Vision Coverage | ||||||

|---|---|---|---|---|---|---|

| (Ages 19 years of age and older*) | Your Cost(In-Network Providers only) | Out-of-network | Subject to Deductible | |||

| Routine Eye Exam (1 visit per year) | 100% covered | Not Covered | No | |||

| Eyeglasses (frames, 1 item per year) | Covered up to $130 | Not Covered | No | |||

| Lenses (per pair): | ||||||

| Single | 100% covered | Not Covered | No | |||

| Bifocal | 100% covered | Not Covered | No | |||

| Trifocal | 100% covered | Not Covered | No | |||

| Lenticular | 100% covered | Not Covered | No | |||

| Contact Lenses: | ||||||

| Contact lenses (in lieu of glasses) | Covered up to $130 | Not Covered | No | |||

| Contact lens fitting | 100% covered | Not Covered | No | |||

| Specialty lens fitting | Covered up to $50 | Not Covered | No |

| Adult Dental Benefits | |||

|---|---|---|---|

| (Ages 19 years of age and older, does not include Pediatric Dental Coverage) | |||

| Annual Maximum Dental Benefit** | $1,000 per covered person per calendar year | ||

| Routine Dental (Class 1) | Your Cost (In-Network Providers only) | Out-of-network | Subject to Deductible |

| Routine Oral Exam (1 per 6 months) | No charge, subject to Annual Maximum | Not Covered | No |

| Routine Cleaning (1 per 6 months) | No charge, subject to Annual Maximum | Not Covered | No |

| Bite-wing X-ray (1 per 12 months) | No charge, subject to Annual Maximum | Not Covered | No |

| Full Mouth X-ray (1 per 60 months) | No charge, subject to Annual Maximum | Not Covered | No |

| Panoramic Film (1 per 60 months) | No charge, subject to Annual Maximum | Not Covered | No |

| Topical Fluoride Application (2 per 12 months) | No charge, subject to Annual Maximum | Not Covered | No |

| Palliative Treatment for relief of pain (minor procedures) | No charge, subject to Annual Maximum | Not Covered | No |

| Basic Dental (Class 2) | Your Cost (In-Network Providers only) | Out-of-network | Subject to Deductible |

| Silver Fillings (1 per 2 years) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Tooth Colored Fillings (1 per 2 years, front teeth only) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Therapeutic Pulpotomy on permanent teeth (1 per lifetime per tooth) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Scaling & Root Planning (1 per 24 months) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Periodontal Maintenance (4 in 12 months) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Simple Extractions | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Surgical Extractions | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Removal of Impacted Teeth | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Alveoloplasty | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Relines (1 per 36 months) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Rebase (1 per 36 months) | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Adjustments | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

| Repairs | 50% coinsurance, subject to Annual Maximum | Not Covered | No |

*If you require coverage for Pediatric Dental please shop on the Health Insurance Marketplace for a stand alone dental plan. **Dental Annual Maximum Benefit does not apply toward any other maximums.

Ambetter Hospital Network

With offices in Indianapolis, Fort Wayne, and Merrillville, Ambetter offers low-cost healthcare throughout much of the state. The 28 participating counties are Adams, Allen, DeKalb, Elkhart, Huntington, Kosciusko, Marshall, St. Joseph, Wells, Whitley, Boone, Clarke, Daviess, Hamilton, Handcock, Harrison, Hendricks, Henry, Howard, Johnson, Knox, Lake, LaPorte, Madison, Marion, Miami, Montgomery, Porter, Pulaski, Steuben, Tippecanoe, and Vanderburgh.

Network Providers The network provider list is quite extensive, and includes primary care physicians, specialists, Urgent-Care locations, hospitals, and many other medical and rehabilitation and treatment facilities. For example, if you lived in the Indianapolis area, the following hospitals would be considered “in-network.” We used a 40-mile radius.

- Community Hospital East

- Westview

- Community Hospital South

- Community Hospital North

- Heart and Vascular

- Community Hospital East

- Hendricks Regional

- Johnson Memorial

- Riverview

- Hancock Memorial

- Witham Memorial

- Community Hospital Of Anderson

- Putnam County

What About Doctors? The availability of primary care physicians (PCP) allows you to choose from many doctors within your area. Specialists, behavioral health, dental and vision options are also plentiful. We listed below the number of network PCPs in several large and small cities. After each city, shown is the number of providers within a 20-mile radius. Typically, the number of available providers increases each year. NOTE: A 24/7 nurse advice line is also available. Registered and licensed nurses can provide professional assistance to current policyholders.

- Bloomington – 5

- Brownsburg – 172

- Carmel – 198

- Evansville – 12

- Fort Wayne – 95

- Hammond – 106

- Indianapolis – 212

- Lafayette – 5

- La Porte – 25

- Lebanon – 73

- Muncie – 54

- Richmond – 4

- South Bend – 144

- Valparaiso – 194

- Vincennes – 26

NOTE: You can also search for your Ambetter provider here.

My Health Pays Reward Program

Start Earning My Health Pays™ rewards today!

YOU CAN USE YOUR REWARDS TO HELP PAY FOR YOUR HEALTHCARE COSTS, SUCH AS: Your monthly premium payments Doctor copays* Deductibles Coinsurance *My Health Pays™ rewards cannot be used for pharmacy copays.

YOU CAN USE YOUR REWARDS TO HELP PAY FOR YOUR HEALTHCARE COSTS, SUCH AS: Your monthly premium payments Doctor copays* Deductibles Coinsurance *My Health Pays™ rewards cannot be used for pharmacy copays.

Complete your Ambetter Wellbeing Survey during the first 90 days of your membership and earn $50 in rewards. Start the survey now!

Complete your Ambetter Wellbeing Survey during the first 90 days of your membership and earn $50 in rewards. Start the survey now!  Get your annual wellness exam with your primary care provider (PCP). Find a PCP.

Get your annual wellness exam with your primary care provider (PCP). Find a PCP.  Receive your annual flu vaccine in the fall (9/1-12/31) and earn $25 in rewards. Schedule it with your PCP.

Receive your annual flu vaccine in the fall (9/1-12/31) and earn $25 in rewards. Schedule it with your PCP. Log in to your secure online member account to track your rewards, view your card balance and complete healthy activities, such as your Wellbeing Survey.

Apply Online Now

Coverage Map

Counties Covered in Indiana by Ambetter

Ambetter Indiana

Overview

Bronze Plans

Silver Plans

Gold Plans

Coverage Map

Hospital List

Contact Us

(312) 726-6565

Agents available M - F

8am - 6pm